nc sales tax on food items

Sales and Use Tax Rates. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax.

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

North Carolina Department of Revenue 11509 Page 2.

. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general. North Carolina has a 475 statewide sales tax rate.

According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7. However some counties in North Carolina have an additional sales tax rate of 2. Purchases food items and combines two or more of the items in a package or gift.

The Dare County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Dare County local sales taxesThe local sales tax consists of a 200 county. The tax rate on most items including hot chocolate is 475. Taxation of Food and.

Items subject to the general rate are also subject to the. This page describes the taxability of. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax.

Sale and Purchase Exemptions. North Carolinas general state sales tax rate is 475 percent. The state sales tax rate in North Carolina is 4750.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. The sales tax rate on food is 2. North Carolina has recent rate changes Fri Jan.

This page discusses various sales tax exemptions in North. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being. The sales tax rate on food is 2.

North Carolina Sales Tax Guide. With local taxes the total sales tax rate is between 6750 and 7500. Certain items have a 7-percent combined general rate and some items have a miscellaneous.

Exemptions to the North Carolina sales tax will. A customer buys a toothbrush a bag of candy and a loaf of bread. The State and applicable local sales and use tax.

Sales and Use Tax Sales and Use Tax. Exemptions to the North Carolina sales tax will. The information included on this website is to be used only as a guide.

Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Arizona grocery items are tax exempt. What transactions are generally subject to sales tax in North Carolina. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically. Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any.

While the North Carolina sales tax of 475 applies to most transactions there are certain items that may be exempt from taxation. Items subject to the general rate are also subject to the. So in those counties the.

Exemptions to the North Carolina sales tax will. Exemption for Packaging Items for Food. It is not intended to cover all provisions of the law or every taxpayers.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

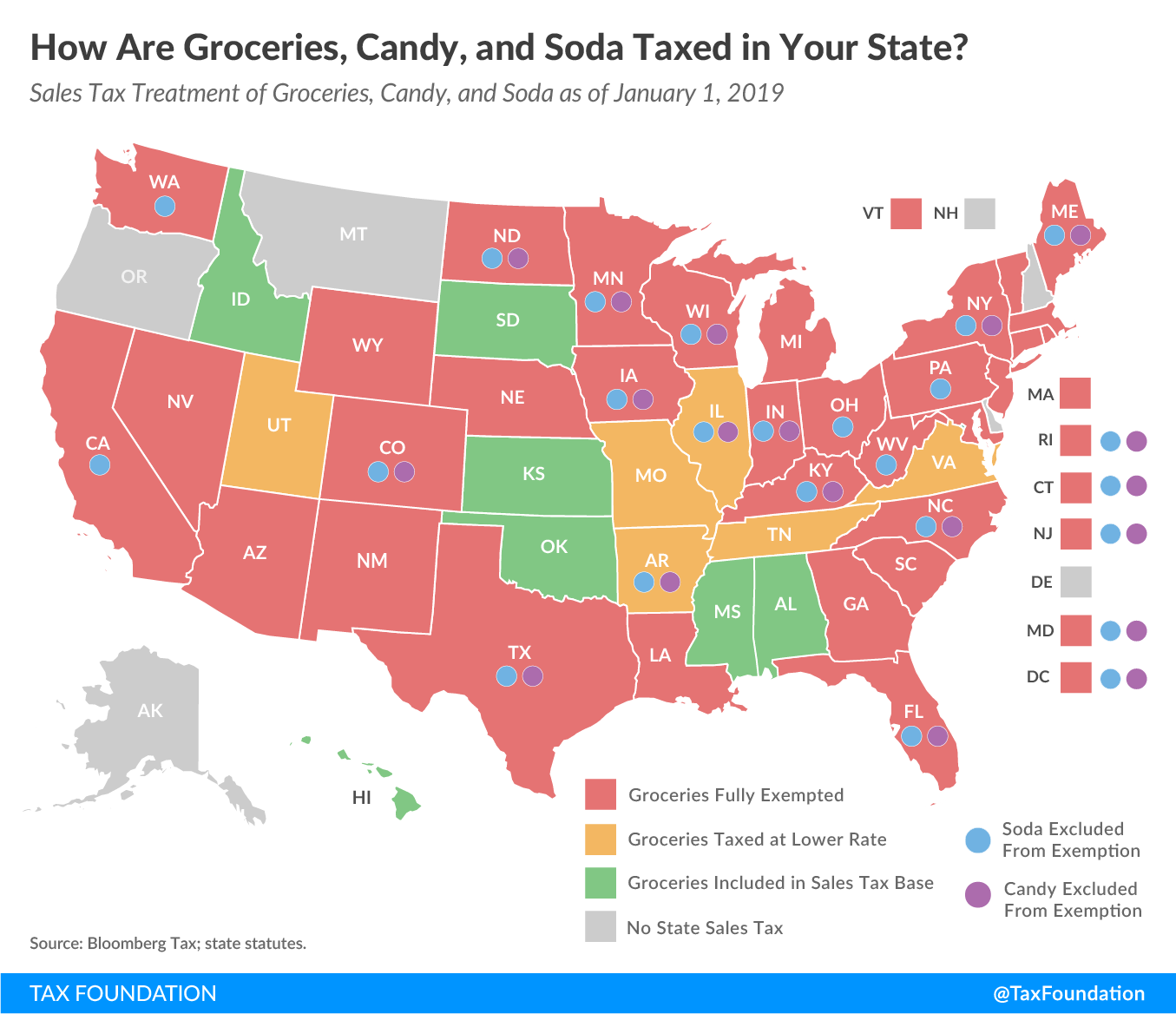

How Are Groceries Candy And Soda Taxed In Your State

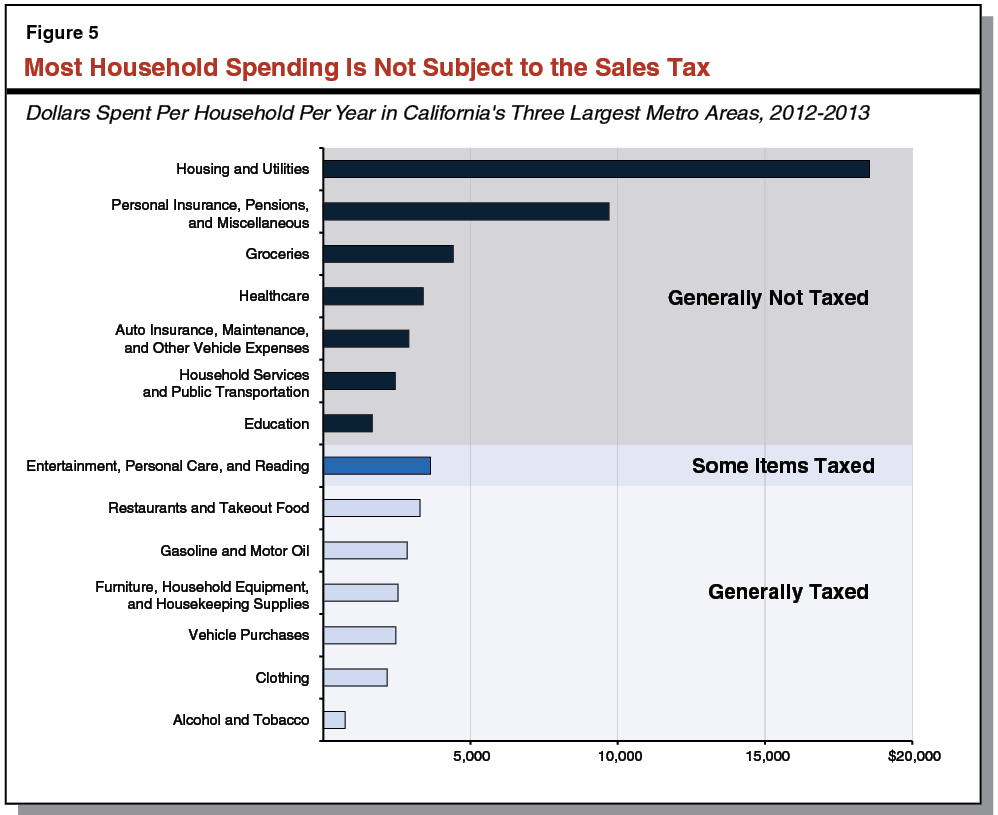

Understanding California S Sales Tax

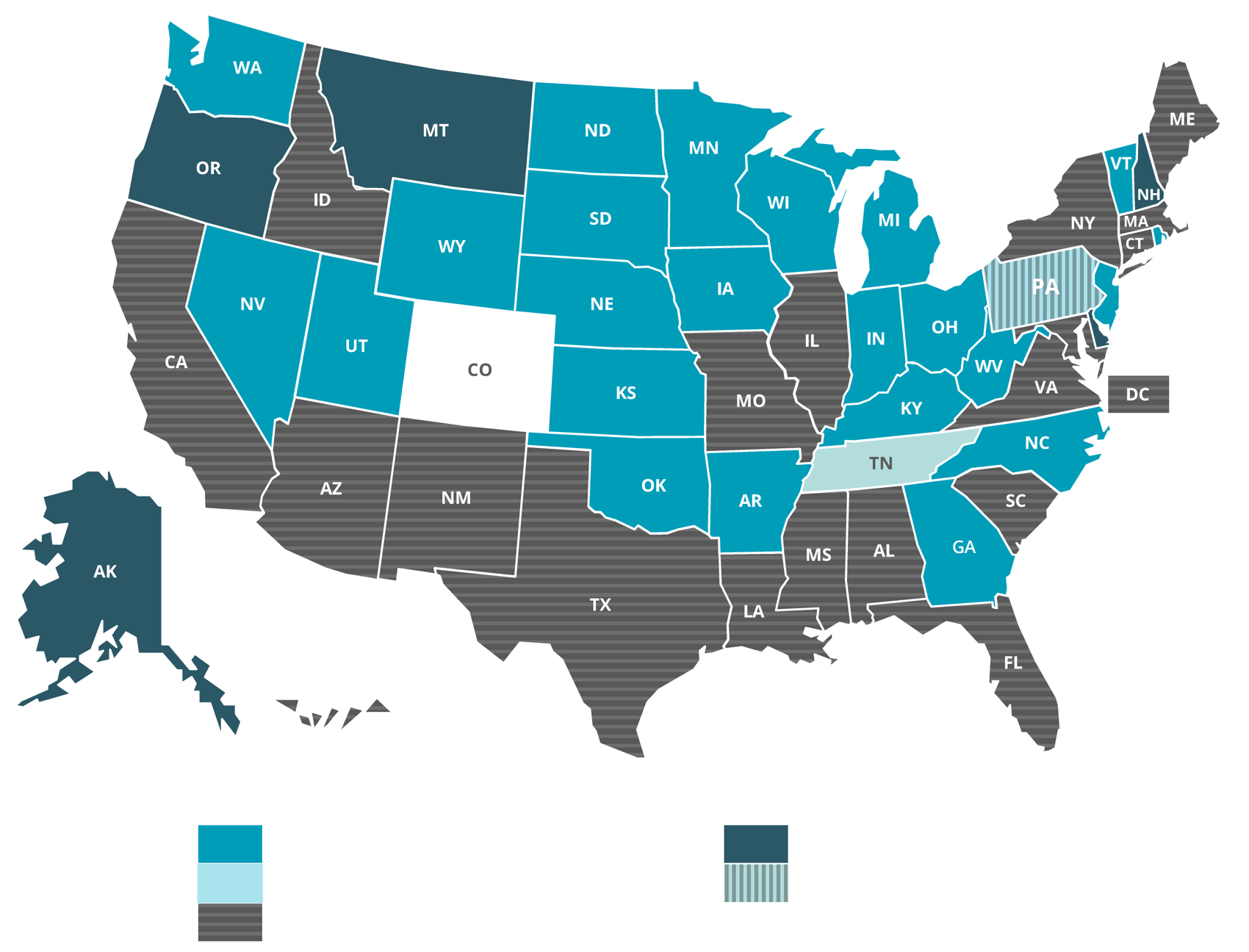

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Washington Sales Tax For Restaurants Sales Tax Helper

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

4 Ways To Calculate Sales Tax Wikihow

Ohio Sales Tax For Restaurants Sales Tax Helper

How To Get A Sales Tax Certificate Of Exemption In North Carolina

Sales Taxes In The United States Wikipedia

How To File And Pay Sales Tax In North Carolina Taxvalet

Decried As Unfair Taxes On Groceries Persist In Some States The Pew Charitable Trusts

2nd Tax On Receipts Confuses Customers At New Walmart Youtube

Nc Sales Tax News For Businesses In North Carolina Gp Cpa

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Flush States May Exempt Food From Sales Tax

More From County Commissioners Budget Workshop Lincoln Herald Lincolnton Nc

Davidson County Sales Tax Referendum Presentation

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation